If you have experience selling real estate and want to take your career to the next level, getting your Georgia broker license is a great choice. It can be a powerful way to boost your revenue, find bigger clients, or take on more responsibilities.

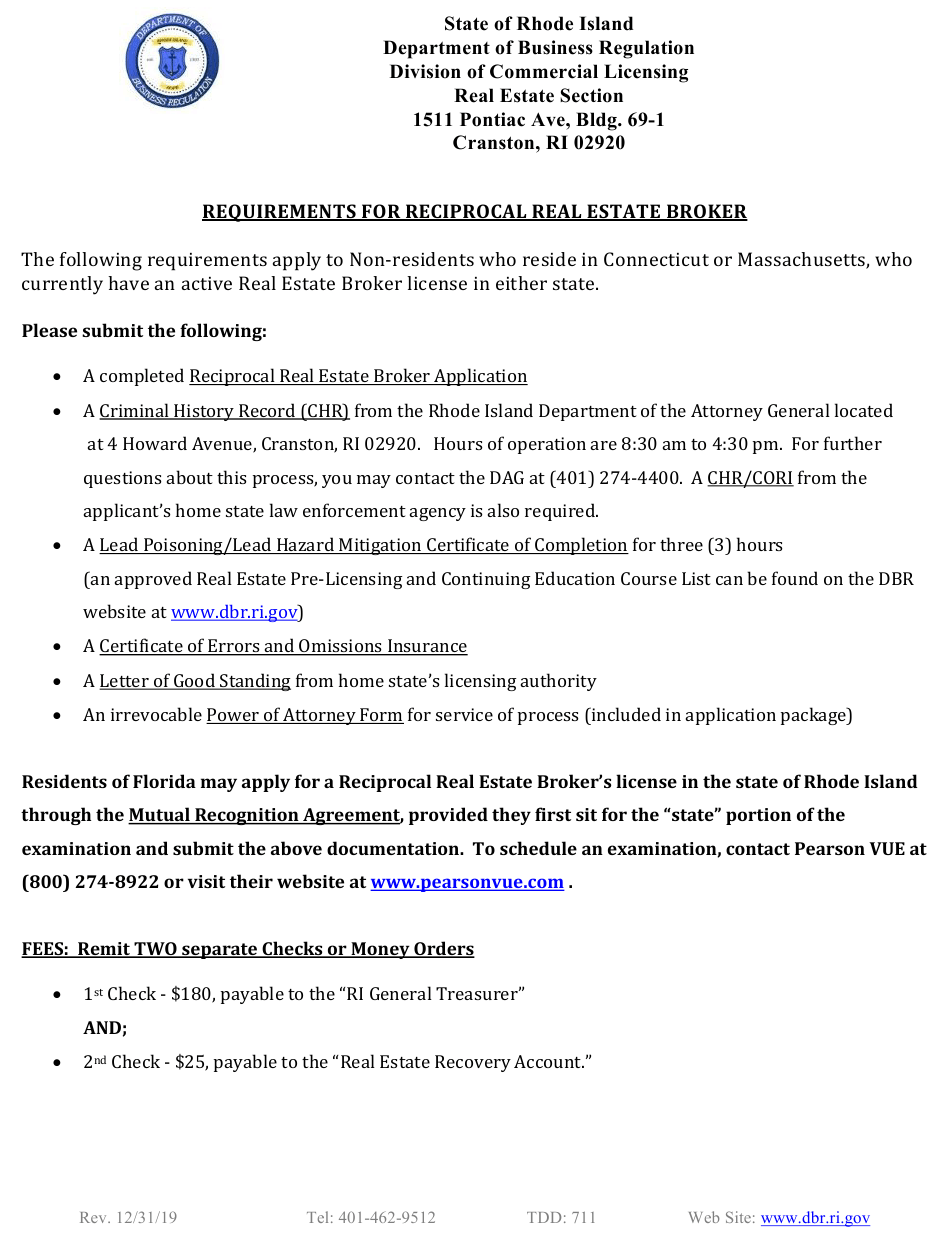

First, obtain your Georgia broker license background report. This is available from your local police department or online. Then you can start the process to complete your broker's application and take the exam.

Qualifying Broker

To qualify for a Georgia Broker License, you will need to pass the Georgia State Exam and meet specific experience requirements. For all real estate broker licenses, a pre-licensing 60-hour class is required before the exam. You can choose to attend a traditional school or an online program, like Colibri Real Estate.

How Do I Become a Real Estate Broker?

For you to become a Georgia real estate agent, you must have at least 2 years full-time sales experience. PSI also administers the broker examination.

How Long Does it Take to Obtain Your Broker License?

It can take 2-4 month to complete the licensing procedure, depending on the speed at which you finish your pre-licensing classes and how well you do in the broker exam. Some motivated individuals are able to finish the course in just a few weeks.

What Is the Georgia Real Estate Broker Exam?

The Georgia Real Estate Broker Exam is a computer-based test that is administered by PSI. The test consists of eleven simulation challenges that are designed to test your decision-making and critical thinking skills. You'll have three hours in which to complete the test. To pass, you'll have to correctly answer 72% or more of the questions.

You can reschedule for illness or other reasons. A fee of $121 will apply. You can also retake the exam within 12 months of taking it if you haven't passed.

How much is it to get a Georgia Broker License?

The license fee for a Georgia broker is $170, which must be paid at the time of your application. You can use a money order, cashier's checks or credit cards to pay.

How Can I prepare myself for the Georgia Broker Exam?

You can improve your chances to pass the Georgia real-estate broker exam by taking an exam preparation course. Many of these course provide useful tools such as practice tests and quizzes that can help you to learn the concepts required for the Georgia broker examination.

How to Apply For a Georgia Broker License

To qualify for a Georgia broker license, you must be a resident of the state or live in a county where a qualifying brokerage is located. You will also need to meet other requirements such as passing the broker test and obtaining an online criminal background check or from your local police agency.

FAQ

Should I use a mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers can negotiate deals for you with multiple lenders. Some brokers receive a commission from lenders. Before signing up, you should verify all fees associated with the broker.

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages lock you in to the same interest rate for the entire term of your loan. This guarantees that your interest rate will not rise. Fixed-rate loan payments have lower interest rates because they are fixed for a certain term.

Do I need to rent or buy a condo?

If you plan to stay in your condo for only a short period of time, renting might be a good option. Renting lets you save on maintenance fees as well as other monthly fees. A condo purchase gives you full ownership of the unit. You can use the space as you see fit.

What are the cons of a fixed-rate mortgage

Fixed-rate mortgages have lower initial costs than adjustable rates. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

What is a Reverse Mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you to borrow money from your home while still living in it. There are two types to choose from: government-insured or conventional. Conventional reverse mortgages require you to repay the loan amount plus an origination charge. FHA insurance covers the repayment.

How much money can I get to buy my house?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com says that the average selling cost for a US house is $203,000 This

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Buy a Mobile Home

Mobile homes are homes built on wheels that can be towed behind vehicles. They were first used by soldiers after they lost their homes during World War II. People who live far from the city can also use mobile homes. These houses are available in many sizes. Some houses have small footprints, while others can house multiple families. There are even some tiny ones designed just for pets!

There are two main types for mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This process takes place before delivery to the customer. You can also build your mobile home by yourself. The first thing you need to do is decide on the size of your mobile home and whether or not it should have plumbing, electricity, or a kitchen stove. Next, make sure you have all the necessary materials to build your home. To build your new home, you will need permits.

You should consider these three points when you are looking for a mobile residence. You might want to consider a larger floor area if you don't have access to a garage. If you are looking to move into your home quickly, you may want to choose a model that has a greater living area. The trailer's condition is another important consideration. You could have problems down the road if you damage any parts of the frame.

You need to determine your financial capabilities before purchasing a mobile residence. It is crucial to compare prices between various models and manufacturers. Also, look at the condition of the trailers themselves. While many dealers offer financing options for their customers, the interest rates charged by lenders can vary widely depending on which lender they are.

Instead of purchasing a mobile home, you can rent one. Renting allows you the opportunity to test drive a model before making a purchase. However, renting isn't cheap. Most renters pay around $300 per month.