How much do real-estate agents make in California?

Agents are independent contractors who earn commissions based upon the number of transactions they make. Agents can increase their earnings over time and have control over how they earn them. This is a huge benefit. California's average commission for agents selling real estate is about $41,000. But, it all depends on the market and how much they sell each year.

What does it take to make a real estate agent a millionaire?

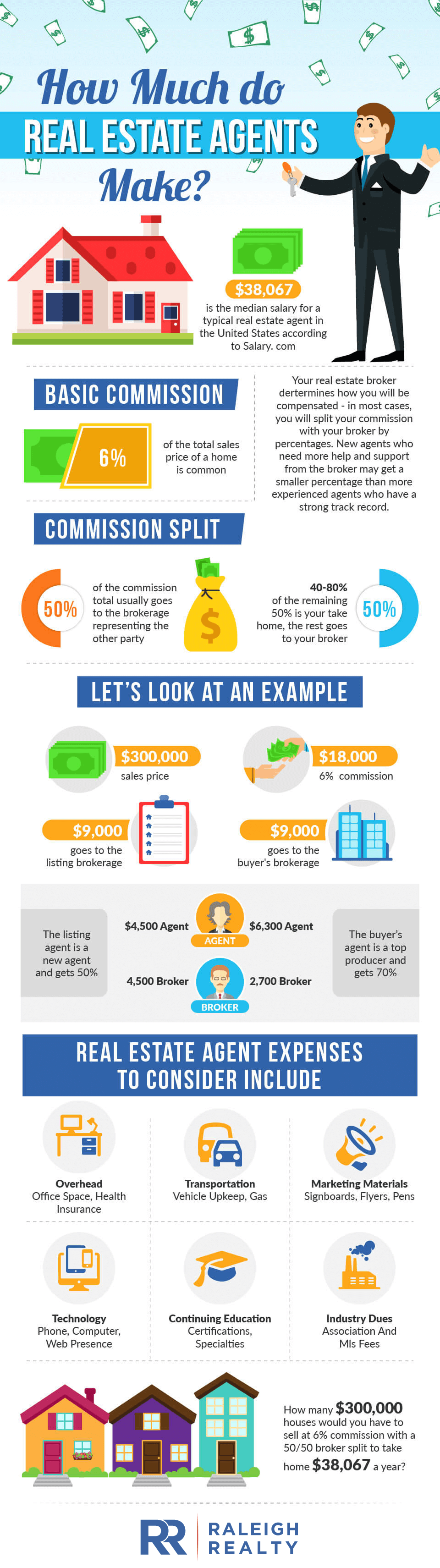

Most agents in America work on commission. A lot of brokers pay agents a basic salary and then a commission for each sale. Agents might also be eligible for other benefits, which they may receive from the broker. Some brokerages provide a flat salary but agents are not allowed to keep all of the commission.

What are the average annual earnings of real estate agents in a single calendar year?

Answering this question depends on many factors such as how many transactions an agent completes and which broker they work with. The typical commission is higher for agents who sell more properties and have higher property values.

How do real-estate agents earn commissions?

California real estate agents can make a living by renting or selling properties. Agents are responsible for finding and marketing homes for sale, representing buyers in the home-search process and ensuring that their clients receive the best possible price for a property. They earn a large commission, which is split between the listing agents and the buyers agents.

What is the average income of real estate agents in one transaction?

Although the average realty commission for a transaction can vary based on location, it generally ranges between 3-6 percent of the total value of the home. The commission is split between the listing agent and the buyer's agent, who then split it with the brokerage.

How do real-estate agents earn a commission selling high-priced houses?

An agent who represents a seller in a $1million home earns about $25,000 per year as a commission. The agent has to share that commission with their sponsoring brokerage, which will often have a 50/50 and even 60/40 split.

How does a real estate agent make a commission on a low-priced house?

This is a tricky question. A typical commission for a realty agent representing a seller of a low-priced property is between 2% to 3%. However, this can go up to 30% if they are representing a buyer.

What is the average salary of a real estate agent working part-time?

Because of the physical demands of their work, part-time agents generally earn less than full-time ones. Additionally, the amount of money a part-time agent earns is also affected by the home prices in the area.

FAQ

How many times can my mortgage be refinanced?

This is dependent on whether the mortgage broker or another lender you use to refinance. In either case, you can usually refinance once every five years.

How can I tell if my house has value?

If your asking price is too low, it may be because you aren't pricing your home correctly. If you have an asking price well below market value, then there may not be enough interest in your home. To learn more about current market conditions, you can download our free Home Value Report.

Is it possible sell a house quickly?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. However, there are some things you need to keep in mind before doing so. First, you will need to find a buyer. Second, you will need to negotiate a deal. The second step is to prepare your house for selling. Third, it is important to market your property. Finally, you should accept any offers made to your property.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Buy a Mobile Home

Mobile homes can be described as houses on wheels that are towed behind one or several vehicles. They were first used by soldiers after they lost their homes during World War II. Today, mobile homes are also used by people who want to live out of town. These houses come in many sizes and styles. Some houses are small, others can accommodate multiple families. Some are made for pets only!

There are two main types for mobile homes. The first type of mobile home is manufactured in factories. Workers then assemble it piece by piece. This process takes place before delivery to the customer. The other option is to construct your own mobile home. You'll need to decide what size you want and whether it should include electricity, plumbing, or a kitchen stove. You'll also need to make sure that you have enough materials to construct your house. Final, you'll need permits to construct your new home.

There are three things to keep in mind if you're looking to buy a mobile home. You may prefer a larger floor space as you won't always have access garage. You might also consider a larger living space if your intention is to move right away. Third, you'll probably want to check the condition of the trailer itself. Damaged frames can cause problems in the future.

Before you decide to buy a mobile-home, it is important that you know what your budget is. It's important to compare prices among various manufacturers and models. Also, look at the condition of the trailers themselves. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

Instead of purchasing a mobile home, you can rent one. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn't cheap. Renters generally pay $300 per calendar month.