Purchasing a home can be an emotional experience. The last thing you want to do is make a bad decision. You should consider the following key elements before you make an offer.

First, you need to decide what your financial means. This is not an exact rule but it is something you should consider when purchasing a home.

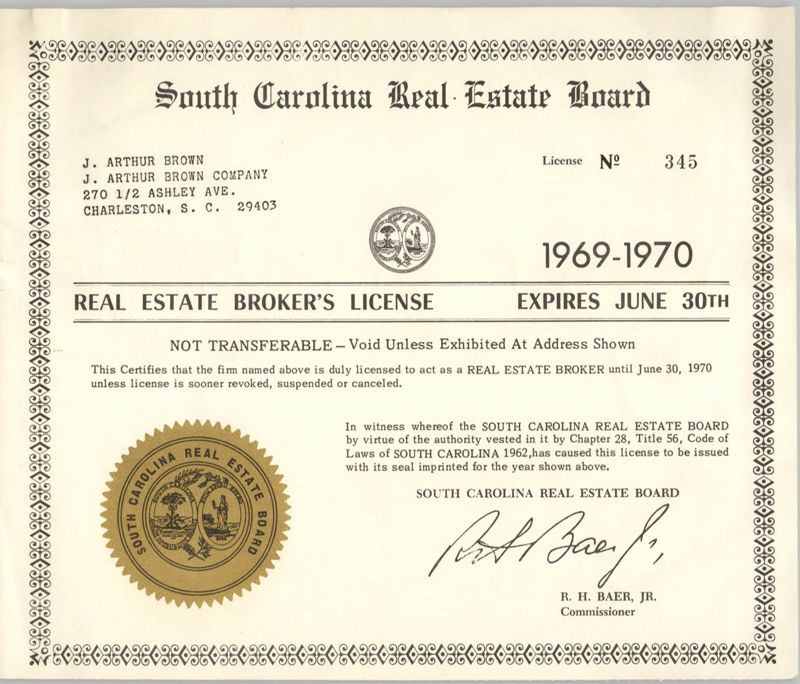

An experienced real estate agent can help you decide what to offer and what price to pay. It is important to evaluate the condition of the property and the local housing market. You also need to consider the seller's requirements. To give the seller time to prepare for the sale, it is important to include a closing date in the offer.

The seller's response is another important aspect of the equation. The seller may refuse to accept your offer or permit a bidding battle to occur. Depending on the circumstances, you may be able to recoup some or all of your down payment by agreeing to a different closing date. You can ask the seller for repairs if you want.

Also, the correct offer will differ depending on the home's price. If the listing is done by a realty agent, you can choose to negotiate the deal yourself or work with them. A real estate lawyer should also be involved if you plan to purchase a home using your own funds.

You might not realize how competitive the real estate market in your local area is. There might be an opportunity to purchase the house of dreams at a great price. You might be able to offer less than what you are willing, but you could also offer more than the asking price.

Your agent can help you make an offer. Your agent can not only be an expert on real-estate, but they will also help find you the best home at a great price. Also, research your local area and the school district. This will help you stand out in the crowd.

A good real estate agent will be more than happy to answer all of your questions and advise you on what to offer and how much to offer. It is important to act quickly if you want the house that you dream of. This is one of your most important decisions. It can also be an emotionally charged experience. Your agent is your best friend during this time.

The above tips will help you make an offer that will be accepted. If you have the right planning and luck, you will be the new owner.

FAQ

How much should I save before I buy a home?

It depends on how much time you intend to stay there. If you want to stay for at least five years, you must start saving now. But if you are planning to move after just two years, then you don't have to worry too much about it.

What are the downsides to a fixed-rate loan?

Fixed-rate mortgages have lower initial costs than adjustable rates. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

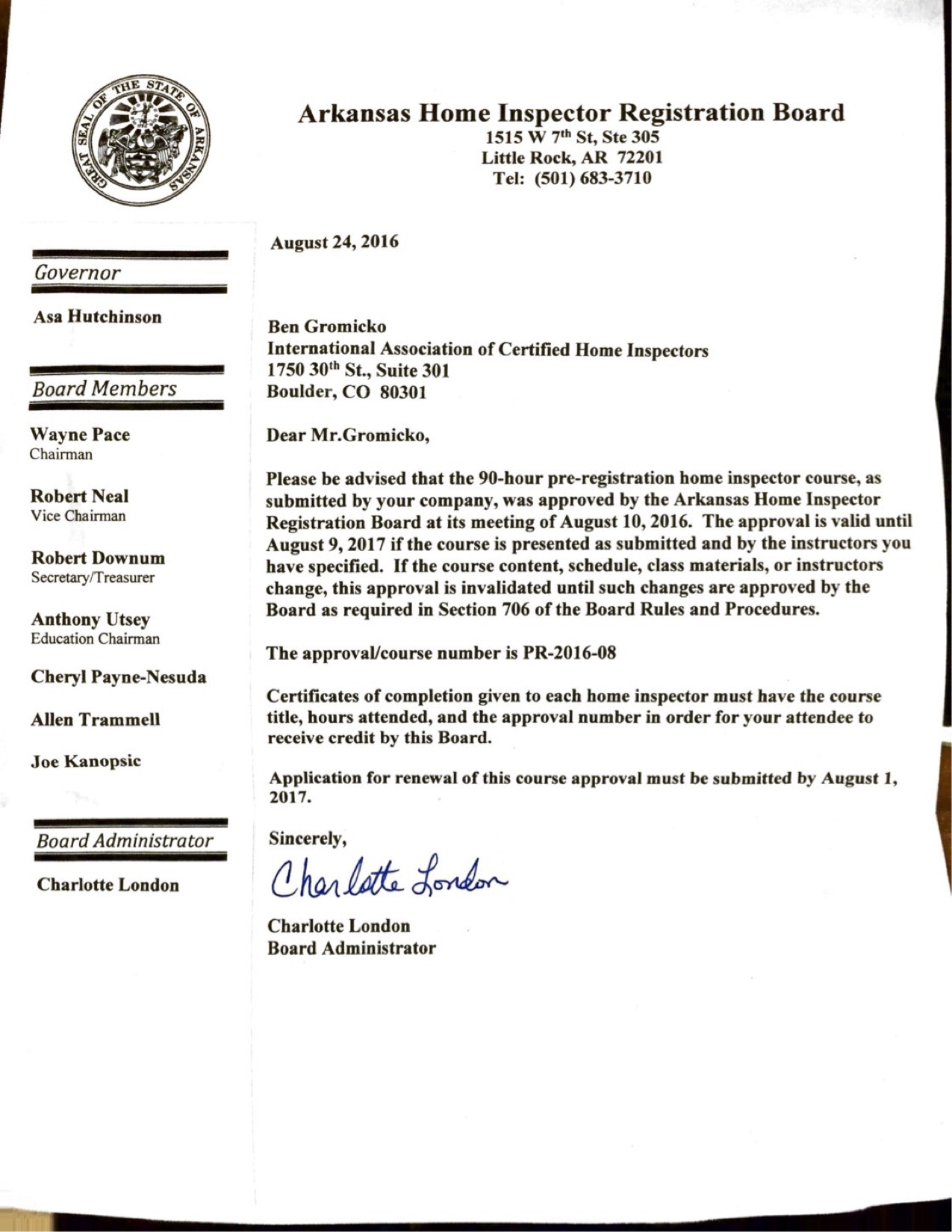

Should I use a broker to help me with my mortgage?

Consider a mortgage broker if you want to get a better rate. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. Before signing up, you should verify all fees associated with the broker.

How much money can I get to buy my house?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

How many times can I refinance my mortgage?

It all depends on whether your mortgage broker or another lender is involved in the refinance. You can typically refinance once every five year in either case.

Can I get a second mortgage?

Yes. However it is best to seek the advice of a professional to determine if you should apply. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to Find a Real Estate Agent

Real estate agents play a vital role in the real estate market. They help people find homes, manage their properties and provide legal advice. The best real estate agent will have experience in the field, knowledge of your area, and good communication skills. Look online reviews to find qualified professionals and ask family members for recommendations. A local realtor may be able to help you with your needs.

Realtors work with buyers and sellers of residential properties. The job of a realtor is to assist clients in buying or selling their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. A commission fee is usually charged by realtors based on the selling price of the property. Unless the transaction closes, however, some realtors charge no fee.

The National Association of Realtors(r), (NAR), has several types of licensed realtors. NAR requires licensed realtors to pass a test. Certification is a requirement for all realtors. They must take a course, pass an exam and complete the required paperwork. Accredited realtors are professionals who meet certain standards set by NAR.