There are many factors to consider when looking for multi-family mortgage loans. These factors include the downpayment, interest rate, as well as other financing options. This article will explain the rates and down payment requirements for these types of loans. Once you have these details figured out, you'll be able to choose the best mortgage loan for your situation.

Rates of multi family mortgage loan

The interest rate on a multi-family mortgage loan is affected by many factors. These loans have higher reserve requirements than conventional loans. This is because a multifamily loan carries a higher level of risk. This is why buyers should seek out a multifamily lender.

A traditional FHA mortgage program permits borrowers to purchase multifamily properties that have up to four units. You will enjoy a lower down payment and a lower interest rate, among other benefits. You will also enjoy lower DTI and less stringent requirements.

Requirements for down payment

The down payment requirements for multifamily mortgage loans are different depending on what type of property. A three-unit multifamily home may require 20% down payment while a 2-unit property might require only 5%. There are also different guidelines from different banks regarding the amount of down payment required to purchase multifamily property.

Multi-family properties have a much higher down payment requirement than single-family homes. However you can still get approved for financing with a small down payment. A few programs may require as little down as 5%, while some lenders may allow you to pay as little down as 1%. There are also programs that allow you to use the down payment of a parent or relative to finance a portion of the mortgage.

Rate requirements

Before applying for a multi-family mortgage loan, there are several things you need to do. Pre-qualification is the first step. This involves an assessment of your credit, income, assets, and other information. Lenders require that you have a credit score of at least 680 to be approved for a loan.

Alternative financing options

Alternative financing presents some challenges. These include limited documentation, a dearth of data on the effectiveness and wide-ranging differences in the types, available financing options, as well as a lack thereof. Lack of research can make it difficult for policymakers to evaluate the benefits and risks of alternative financing.

Private equity, online marketplaces, and debt funds are some of the alternatives to multifamily mortgage loan financing. Private equity funds can often be used to finance commercial real-estate deals. These funds pool the capital and provide equity or debt financing to borrowers. This type financing is not appropriate for all circumstances and requires careful research.

FAQ

Is it possible fast to sell your house?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. However, there are some things you need to keep in mind before doing so. First, you will need to find a buyer. Second, you will need to negotiate a deal. The second step is to prepare your house for selling. Third, you need to advertise your property. You should also be open to accepting offers.

Is it better buy or rent?

Renting is typically cheaper than buying your home. However, renting is usually cheaper than purchasing a home. Buying a home has its advantages too. For example, you have more control over how your life is run.

What amount of money can I get for my house?

It depends on many factors such as the condition of the home and how long it has been on the marketplace. According to Zillow.com, the average home selling price in the US is $203,000 This

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

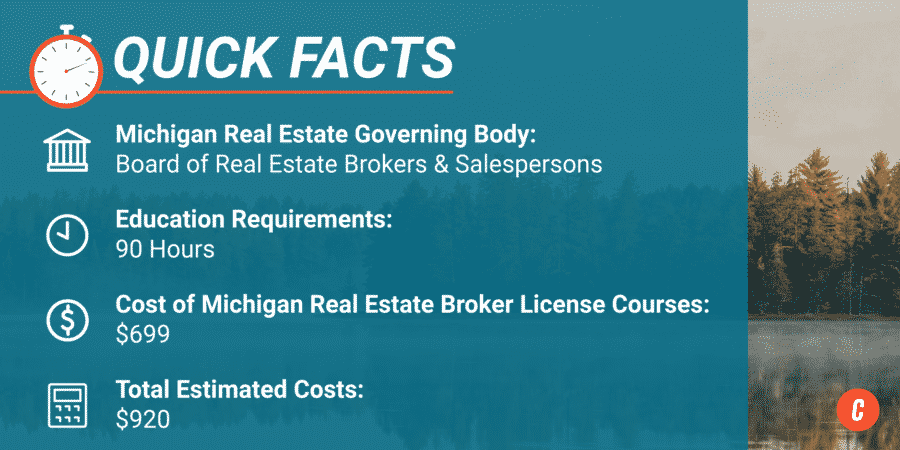

How to become a real estate broker

You must first take an introductory course to become a licensed real estate agent.

Next you must pass a qualifying exam to test your knowledge. This requires studying for at minimum 2 hours per night over a 3 month period.

Once you have passed the initial exam, you will be ready for the final. In order to become a real estate agent, your score must be at least 80%.

Once you have passed these tests, you are qualified to become a real estate agent.