Multi-family mortgage loans are available. There are many things you need to take into consideration. These factors include down payment, interest rates, and other financing options. This article will provide information on the down payment and rates for these types loans. Once you have this information, you will be able choose the best mortgage for you.

Multifamily mortgage loan rates

Multi-family mortgage loans have a variety of factors that can influence their interest rates. The first is that these loans typically have higher reserve requirements than conventional loans. Multifamily loans are more risky than conventional loans. For this reason, buyers should try to find a lender that specializes in multifamily loans.

A traditional FHA mortgage program permits borrowers to purchase multifamily properties that have up to four units. Its low down payment and lower interest rate are some of its benefits. Other benefits include less stringent requirements and lower DTI.

Requirements for down payment

Multi-family mortgage loans have different down payment requirements depending on the property. A multifamily property of three units may require a 20% downpayment while a multifamily property of two units may only require a 5% deposit. A multifamily property may require a 20% down payment. Different banks will have different guidelines.

Multi-family properties require a significantly larger down payment than single-family homes. However, it is possible to still be approved for a loan with a lower down payment. There are a few programs that require as little as five percent down, and some lenders may allow as little as zero down. Programs that allow you use the downpayment of a relative or parent in order to finance a part of your mortgage can also be found.

Prerequisites for interest rate

There are several requirements that must be met before you can apply for a multi-family loan. Pre-qualification refers to a review of your assets, income, credit score and credit history. Lenders require that you have a credit score of at least 680 to be approved for a loan.

Alternate financing options

Alternative financing comes with some problems. The challenges include limited documentation, lack of data regarding alternative financing effectiveness, and wide differences between states in the types. Policymakers may not be able to assess the benefits and harms of alternative financing if there isn't enough research.

Private equity, debt funding, and online marketplaces offer alternative financing options for multifamily mortgage loan requirements. Private equity funds often finance commercial real estate transactions. These funds combine the capital of several investors to provide equity or debt financing to borrowers. This type financing is not appropriate for all circumstances and requires careful research.

FAQ

What are the benefits to a fixed-rate mortgage

A fixed-rate mortgage locks in your interest rate for the term of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans also come with lower payments because they're locked in for a set term.

What are the chances of me getting a second mortgage.

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

What is the average time it takes to sell my house?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It may take up to 7 days, 90 days or more depending upon these factors.

How much money should I save before buying a house?

It depends on how much time you intend to stay there. If you want to stay for at least five years, you must start saving now. If you plan to move in two years, you don't need to worry as much.

How do I fix my roof

Roofs can leak because of wear and tear, poor maintenance, or weather problems. Repairs and replacements of minor nature can be made by roofing contractors. For more information, please contact us.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to Find a Real Estate Agent

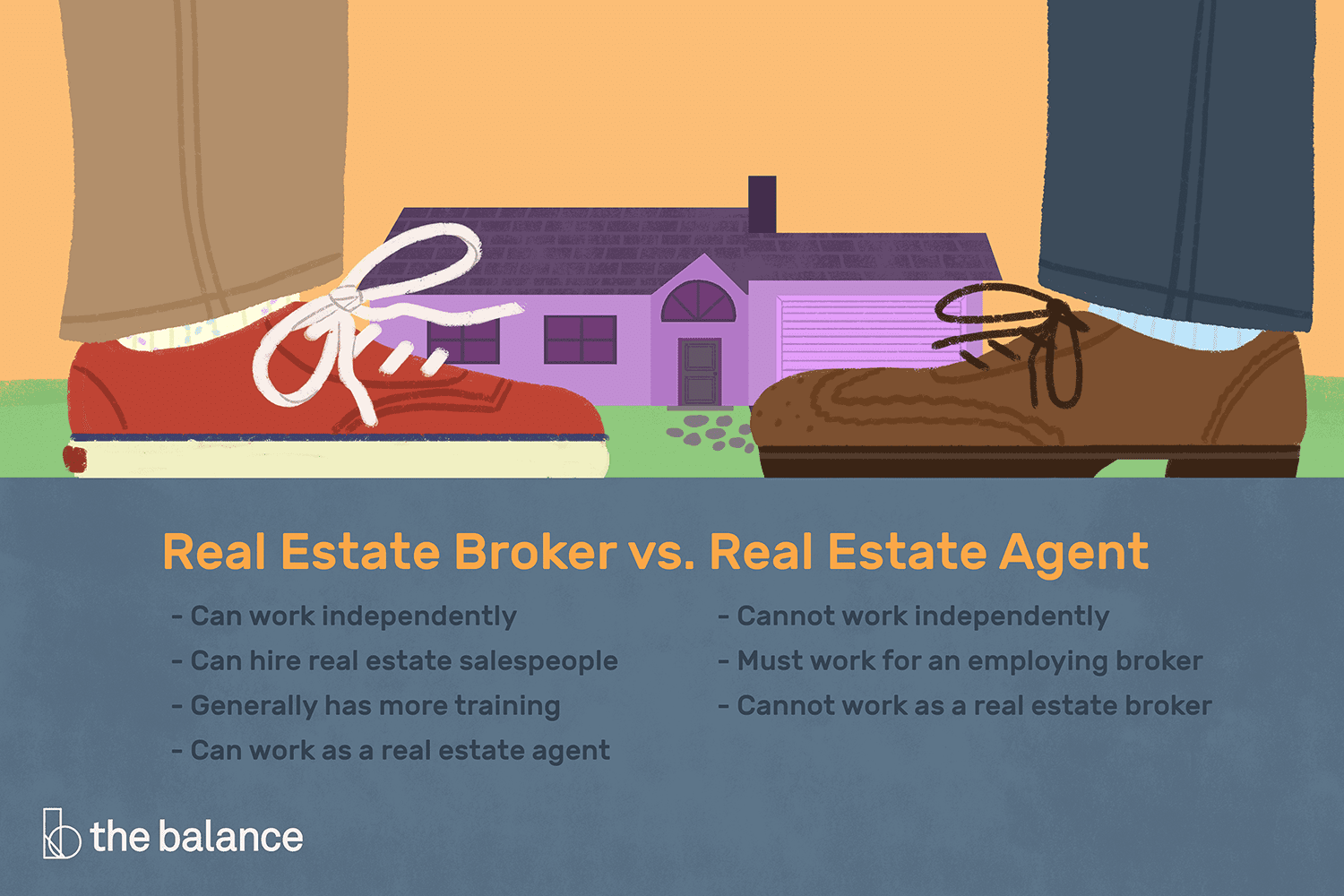

The real estate agent plays a crucial role in the market. They sell homes and properties, provide property management services, and offer legal advice. You will find the best real estate agents with experience, knowledge and communication skills. To find a qualified professional, you should look at online reviews and ask friends and family for recommendations. Consider hiring a local agent who is experienced in your area.

Realtors work with sellers and buyers of residential property. The job of a realtor is to assist clients in buying or selling their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. A majority of realtors charge a commission fee depending on the property's sale price. Unless the transaction closes, however, some realtors charge no fee.

There are many types of realtors offered by the National Association of REALTORS (r) (NAR). To become a member of NAR, licensed realtors must pass a test. A course must be completed and a test taken to become certified realtors. NAR designates accredited realtors as professionals who meet specific standards.