Pros and cons of real estate

It is important that you weigh the pros and con's when making a decision about whether or not you will become a licensed real estate agent. This is a major career decision that can have lasting effects on your life.

Let's discuss the pros of becoming a real estate agent. This is a great career choice if you are a good communicator and enjoy working with people. You will meet many people from diverse backgrounds and learn new things everyday.

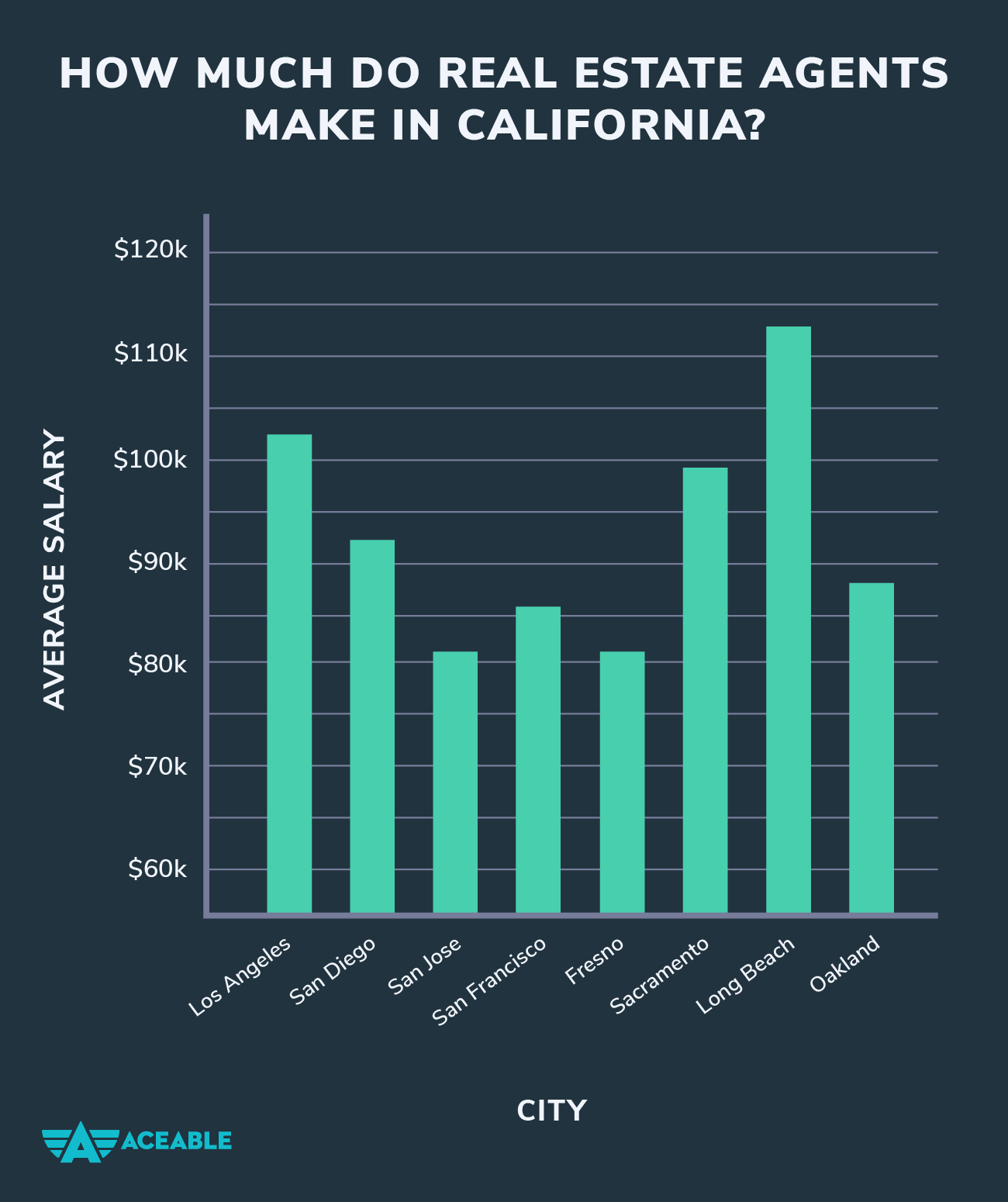

Real estate agents can also make big money. Agents are typically paid a percentage of the selling price. This is an excellent way to make a good income, especially if you're able to sell properties quickly and at a high price.

Being a professional real estate agent offers many benefits. This can be huge for those who require flexibility or wish to make more money.

But you need to be careful if your goal is to become a successful real estate agent. This applies to every industry, but is particularly relevant for real estate.

Being a real-estate agent has many advantages. It is easy to see why so much people want to be in this business. This could be the right job for you if you are interested in a career that involves a lot of customer service, marketing, and networking.

The best thing about being an agent in real estate is the ability to travel and see many properties. This will enable you to increase your market knowledge as well as make your clients satisfied.

A real estate agent is also an option if you're looking to build your own property portfolio. This will give you the opportunity to purchase multiple commercial properties and homes, which can help you improve your financial future.

It can be costly to purchase and keep investment properties. However, there are many avenues that you can use to search for the perfect property. Finding a location where prices are rising is key to increasing the value of your investment.

It's also a great way to generate tax-deductible income. Tax returns allow you to deduct mortgage interest, property taxes and maintenance costs.

You'll also pay lower taxes on any profits you make when you sell your investment properties. This is called capital gains and it can provide extra income while paying lower taxes than your wages.

Being an investment realtor has many benefits. But it's crucial to know exactly what you're getting into. Before making any investment, you should research properties and find a good attorney.

FAQ

How many times may I refinance my home mortgage?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. In either case, you can usually refinance once every five years.

How can I determine if my home is worth it?

If you have an asking price that's too low, it could be because your home isn't priced correctly. A home that is priced well below its market value may not attract enough buyers. Our free Home Value Report will provide you with information about current market conditions.

What should I look for in a mortgage broker?

Mortgage brokers help people who may not be eligible for traditional mortgages. They shop around for the best deal and compare rates from various lenders. This service may be charged by some brokers. Others provide free services.

What are the most important aspects of buying a house?

The three main factors in any home purchase are location, price, size. It refers specifically to where you wish to live. Price is the price you're willing pay for the property. Size refers to how much space you need.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate mortgages have lower initial costs than adjustable rates. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

How do I calculate my interest rates?

Interest rates change daily based on market conditions. The average interest rate over the past week was 4.39%. Add the number of years that you plan to finance to get your interest rates. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Buy a Mobile Home

Mobile homes are houses built on wheels and towed behind one or more vehicles. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. People who live far from the city can also use mobile homes. These homes are available in many sizes and styles. Some houses are small while others can hold multiple families. Even some are small enough to be used for pets!

There are two main types mobile homes. The first type of mobile home is manufactured in factories. Workers then assemble it piece by piece. This is done before the product is delivered to the customer. You can also build your mobile home by yourself. Decide the size and features you require. Next, ensure you have all necessary materials to build the house. Final, you'll need permits to construct your new home.

Three things are important to remember when purchasing a mobile house. A larger model with more floor space is better for those who don't have garage access. A model with more living space might be a better choice if you intend to move into your new home right away. Third, make sure to inspect the trailer. If any part of the frame is damaged, it could cause problems later.

It is important to know your budget before buying a mobile house. It is crucial to compare prices between various models and manufacturers. It is important to inspect the condition of trailers. While many dealers offer financing options for their customers, the interest rates charged by lenders can vary widely depending on which lender they are.

It is possible to rent a mobile house instead of buying one. You can test drive a particular model by renting it instead of buying one. Renting is expensive. The average renter pays around $300 per monthly.