Here are some ways to maximize the returns you get from real estate investing. You can learn more about what types of properties you could invest in by reading the following article. We will also be discussing the importance and benefits of location, asset preservation, and refinancing current properties. These tips will help you maximize your investment success. This article will be especially useful if this is your first time investing or you plan on buying multiple properties.

Investment properties

What makes investment properties suitable for real estate investors attractive? It all depends on your goals, your market, and your preferred investment strategy. There is no one right answer to these questions, and weighing the pros and cons of different investment options is essential. The location is important as well. Investors in "up-and coming" markets may be more interested vacant land investments, while investors in "mature markets" may be more attracted to residential properties.

Asset protection

If you're serious about investing in real estate, there are a few different strategies you can use to protect your assets. Most real estate investors use landlord insurance and a conservative amount of debt, but holding real estate in an LLC or trust is another good way to increase your asset protection. You should also consider how much equity you've built up in your properties. Your goals, risk tolerance, and investments will all play a role in the choice of strategy.

Lage

Real estate investing depends on location. This will impact the return on your investment. Even though cheaper properties might not be as profitable as those with higher prices, it is worth considering the area surrounding your property. Some neighborhoods are vibrant, while others may not make the best investments. Consider the area's affordability and job market to determine whether it is the right investment for you. Finally, be sure to check the property thoroughly before making a final decision.

Refinance existing properties

Real-estate investors have the option to refinance existing properties, which allows them to enjoy lower interest rates with lower monthly payments. This can help maximize their investment. You can use equity from your properties to improve them or to finance investment properties. Refinances can also be eligible for tax deductions. This is a great option to consider for investors. However, it involves several steps. Here's how to get started:

Manage your portfolio

There are many decisions that you need to make when creating your own portfolio of real estate investments. Your goals and your risk tolerance will determine the appropriate asset allocation. Investors who seek higher returns will need to be willing to take on more risk, while those seeking stable income will prefer to make safer investments. A greater tolerance for risk will lead to a more aggressive investment portfolio in real estate. How do you decide which investments to make?

FAQ

How can I get rid Termites & Other Pests?

Termites and many other pests can cause serious damage to your home. They can cause serious destruction to wooden structures like decks and furniture. You can prevent this by hiring a professional pest control company that will inspect your home on a regular basis.

Should I rent or purchase a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting will allow you to avoid the monthly maintenance fees and other charges. A condo purchase gives you full ownership of the unit. You are free to make use of the space as you wish.

Is it possible to sell a house fast?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. Before you sell your house, however, there are a few things that you should remember. First, you will need to find a buyer. Second, you will need to negotiate a deal. The second step is to prepare your house for selling. Third, advertise your property. Lastly, you must accept any offers you receive.

How long does it take for a mortgage to be approved?

It depends on several factors including credit score, income and type of loan. Generally speaking, it takes around 30 days to get a mortgage approved.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

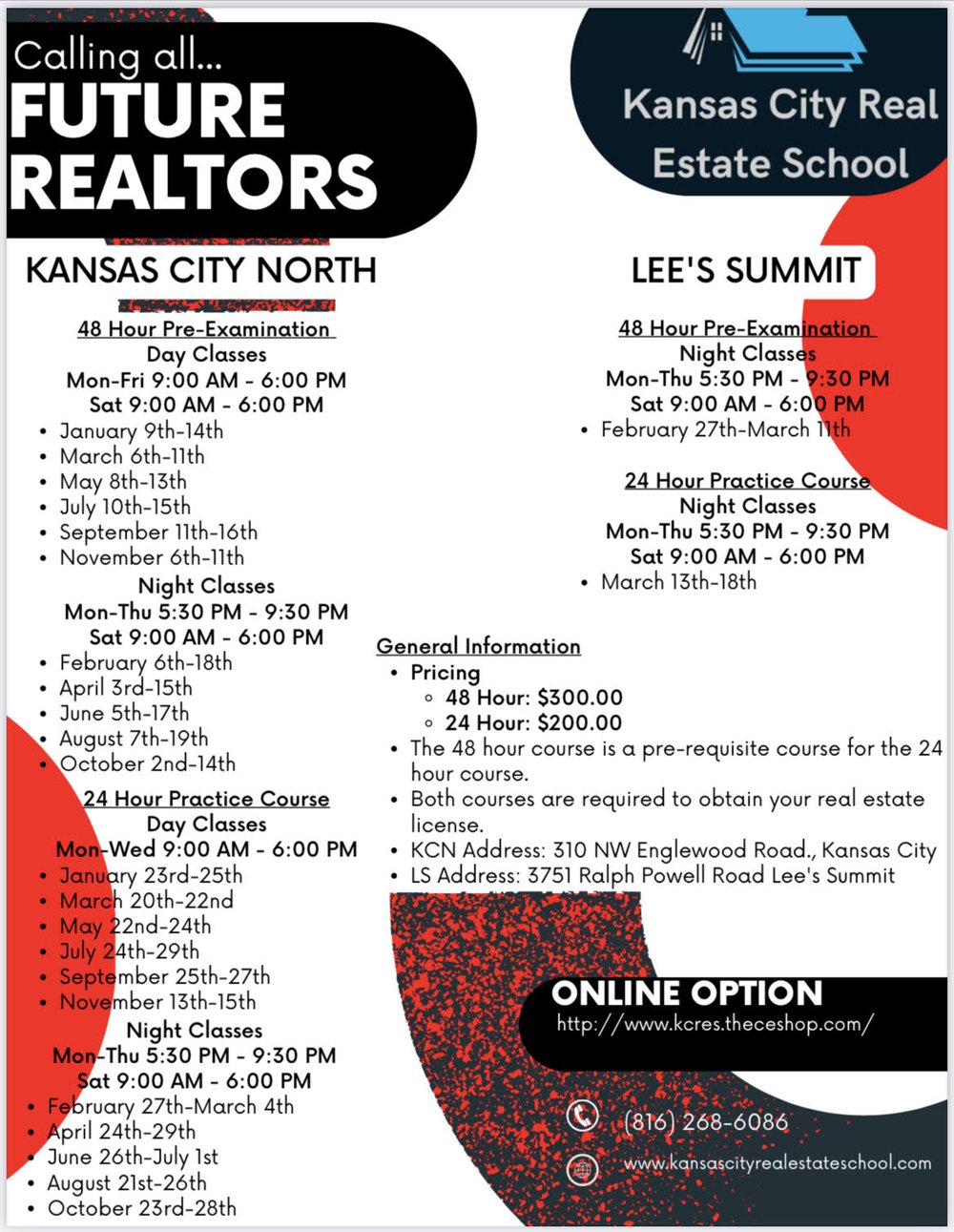

How to become a real estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This involves studying for at least 2 hours per day over a period of 3 months.

Once you have passed the initial exam, you will be ready for the final. To become a realty agent, you must score at minimum 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!