Illinois is home of more real-estate brokers than any other state. With a median income of $103,430, this job is one of the most lucrative in America. This is why Illinois real estate brokers are increasingly choosing to get the managing broker license. They can either manage other brokers or run their own businesses.

How to obtain a Illinois Managing Broker License

It is necessary to take the pre-license education classes and pass your licensing exam to obtain a managing brokers license. You can take the courses in a classroom or online.

Once you complete your pre-license education, you can then take the Illinois Managing Broker Exam administered by PSI. The exam is a computer-based, multiple-choice test and requires a passing score of 75%.

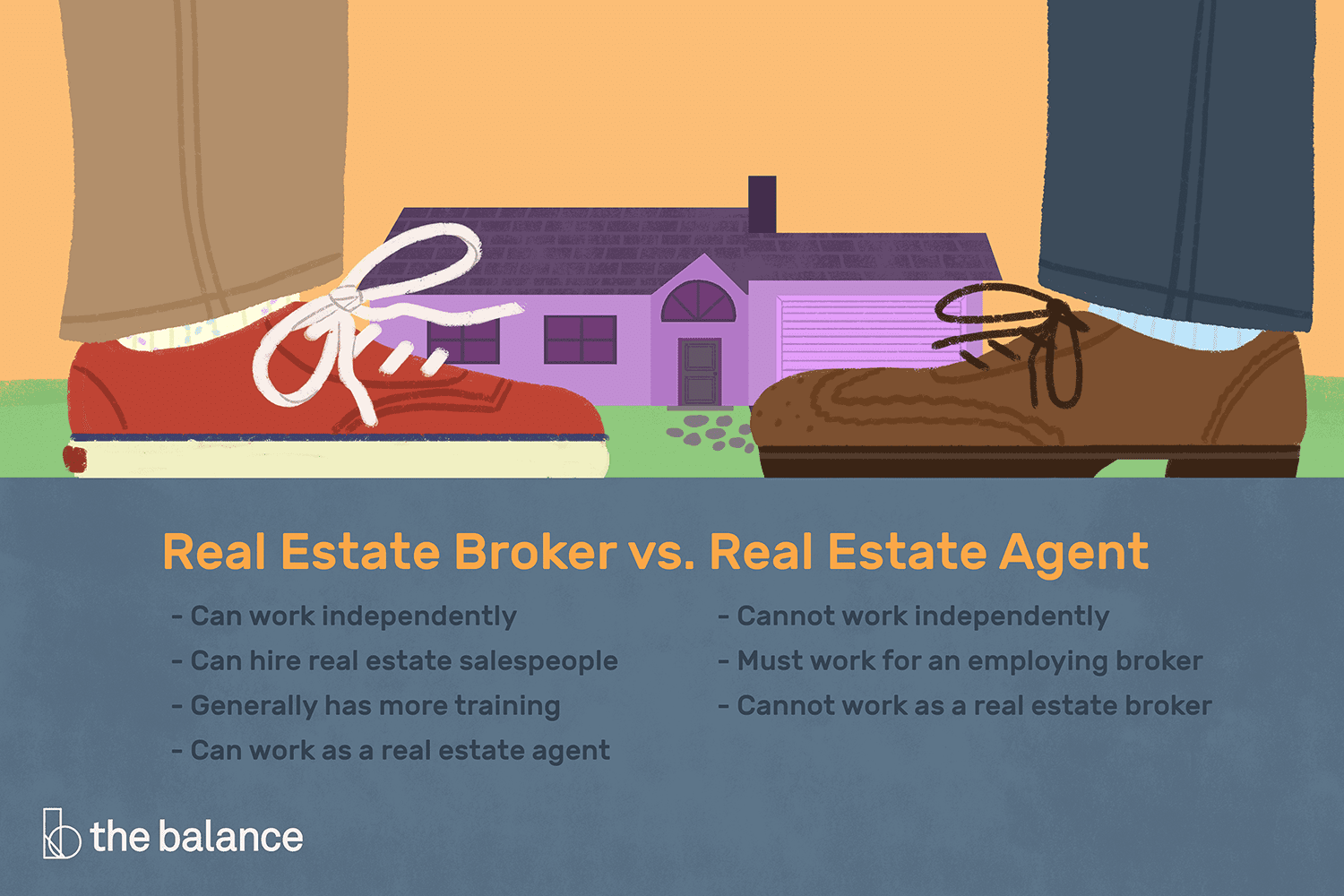

A managing broker is responsible to oversee the operations of a brokerage. He/she may hire real estate agents, and ensure that all parties in transactions follow state licensing laws. They may meet with clients to discuss the needs of their clients and give advice about real estate matters.

It is the responsibility of managing brokers to ensure that their company complies with all Illinois state and federal law. This may include creating policies and procedures, working alongside new agents, and meeting stakeholders to ensure that future support is provided.

What is a Managing Broker?

A real estate manager broker is a licensed broker who manages agents to ensure high-quality service for clients. Managers work closely with their colleagues, and are able to focus on the needs of clients, rather than salespersons.

The Illinois realty industry is strong. It saw a mean sale price in 2010 of $181,000 which is nearly double the 2008 figure. That means there's plenty of room to grow in this career, especially since the average salary is higher in Chicago than in any other city in the country.

How to Become A Managing Broker in Illinois

A managing broker is a licensed real estate agent who has been authorized by a sponsoring broker to handle all of the responsibilities of the real estate brokerage firm's daily operations. They can be supervisors of the real estate agents' daily activities. They often have a business or management degree.

To be eligible for a managing brokerage license, applicants must have had an active Illinois license for at most 2 years before taking the exam. They must also have a minimum of two years of real-estate experience, including brokerage experience.

How to Obtain an Illinois Managing Broker License

45 hours of post-license education is required to start the process for obtaining an Illinois managing broker license. These hours are completed from a state-licensed real estate school, such as Colibri Real Estate, and consist of Broker Post License Transactional Issues (15 hours), Broker Post License Risk Management/Discipline (15 hours), and Broker Post License Applied Broker Principles (15 hours).

After you complete your post-license coursework, you must submit an application to the Illinois Department of Financial & Professional Regulation (IDFPR) along with the required fee. This process may take up 12 months from the moment you begin your classes to fulfill all your requirements.

FAQ

How much does it cost for windows to be replaced?

Windows replacement can be as expensive as $1,500-$3,000 each. The cost to replace all your windows depends on their size, style and brand.

How can I tell if my house has value?

You may have an asking price too low because your home was not priced correctly. A home that is priced well below its market value may not attract enough buyers. Our free Home Value Report will provide you with information about current market conditions.

How do I eliminate termites and other pests?

Your home will be destroyed by termites and other pests over time. They can cause serious damage and destruction to wood structures, like furniture or decks. It is important to have your home inspected by a professional pest control firm to prevent this.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to Buy a Mobile Home

Mobile homes are houses built on wheels and towed behind one or more vehicles. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. People who want to live outside of the city are now using mobile homes. These houses are available in many sizes. Some houses are small, others can accommodate multiple families. Some are made for pets only!

There are two main types of mobile homes. The first is made in factories, where workers build them one by one. This occurs before delivery to customers. The other option is to construct your own mobile home. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. You'll also need to make sure that you have enough materials to construct your house. You will need permits to build your home.

If you plan to purchase a mobile home, there are three things you should keep in mind. First, you may want to choose a model that has a higher floor space because you won't always have access to a garage. A larger living space is a good option if you plan to move in to your home immediately. You should also inspect the trailer. Damaged frames can cause problems in the future.

You need to determine your financial capabilities before purchasing a mobile residence. It's important to compare prices among various manufacturers and models. Also, consider the condition the trailers. While many dealers offer financing options for their customers, the interest rates charged by lenders can vary widely depending on which lender they are.

You can also rent a mobile home instead of purchasing one. Renting allows you to test drive a particular model without making a commitment. Renting is expensive. Renters typically pay $300 per month.