Real estate appraisers have a license and are professionals who can provide unbiased opinions on the value of a property. Market research, inspections and reports are written for lenders. This is a very regulated industry, with many steps an aspiring appraisal must take to start their career.

How to become an appraiser

You will need to take several courses, and pass exams in order to launch your career as a professional real estate appraiser. You should also find a mentoring who will supervise your training and guide you in getting started.

To become a licensed appraiser trainee, you will need to complete 79 hours in qualifying education. This is the perfect way to learn real estate appraiser basics and gain experience with a qualified instructor. You will also need to meet state licensing and certification requirements.

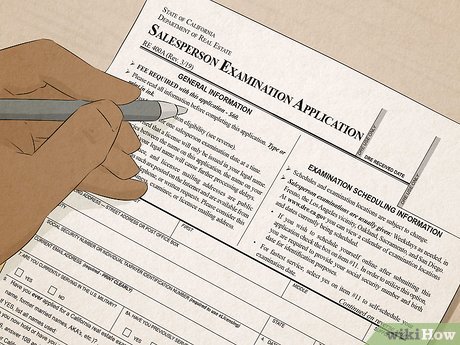

It's now time to sit the appraisal examination. This exam determines whether you can become a licensed appraisal in your state.

Next, you'll need to obtain a certificate from your local government agency and submit the required documents to your state's appraisal board. You can then start working as an appraiser.

Depending upon your level of expertise, you could work as an independent appraiser or for a financial institution. Appraisers work with clients such as individual property owners, lenders, banks and other financial institutions who require an appraisal to support a loan amount.

You will need to invest a lot time in doing research online, inspecting property, and preparing appraisal reports if you decide to become an independent appraiser. This can be an extremely time-consuming process, particularly if you want to find new clients.

If you decide to become an appraiser at a financial institution or firm, you will have greater flexibility, and you can work with a variety of clients. These firms and institutions tend to be larger and offer more stable job opportunities.

The type of client with whom you work will determine your salary. If you are employed by a large management company for appraisals, your salary will be higher than if the appraiser was working independently.

To become a Licensed Appraiser, you need to have a minimum experience of 1,000 hours with a supervisor. Keep a detailed log of the work you have done so that later, when applying for a state appraisal license or certification at a national level, you can submit it to an appraiser's agency.

After you receive your Certified Residential Appraiser license, you will be able to begin taking the required classes. The first course you'll need to complete is Basic Appraisal Principles (also known as the Uniform Standards of Professional Appraisal Practice or USPAP).

After that, you'll need to take a number of other classes. The classes you need to take will depend on your state and what level you want to achieve as an appraiser.

FAQ

How can I calculate my interest rate

Market conditions can affect how interest rates change each day. The average interest rate over the past week was 4.39%. Add the number of years that you plan to finance to get your interest rates. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

Can I get another mortgage?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

What should I consider when investing my money in real estate

The first thing to do is ensure you have enough money to invest in real estate. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should include mortgage payments, taxes, insurance and maintenance costs.

You must also ensure that your investment property is secure. You would be better off if you moved to another area while looking at properties.

Is it possible sell a house quickly?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. There are some things to remember before you do this. You must first find a buyer to negotiate a contract. Second, you need to prepare your house for sale. Third, it is important to market your property. Lastly, you must accept any offers you receive.

How much money can I get to buy my house?

The number of days your home has been on market and its condition can have an impact on how much it sells. According to Zillow.com, the average home selling price in the US is $203,000 This

How much money should I save before buying a house?

It depends on the length of your stay. If you want to stay for at least five years, you must start saving now. You don't have too much to worry about if you plan on moving in the next two years.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Purchase a Mobile Home

Mobile homes can be described as houses on wheels that are towed behind one or several vehicles. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. Today, mobile homes are also used by people who want to live out of town. These homes are available in many sizes and styles. Some houses can be small and others large enough for multiple families. There are even some tiny ones designed just for pets!

There are two types of mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This occurs before delivery to customers. You could also make your own mobile home. The first thing you need to do is decide on the size of your mobile home and whether or not it should have plumbing, electricity, or a kitchen stove. Next, make sure you have all the necessary materials to build your home. To build your new home, you will need permits.

There are three things to keep in mind if you're looking to buy a mobile home. You might want to consider a larger floor area if you don't have access to a garage. If you are looking to move into your home quickly, you may want to choose a model that has a greater living area. Third, make sure to inspect the trailer. Damaged frames can cause problems in the future.

Before you decide to buy a mobile-home, it is important that you know what your budget is. It is crucial to compare prices between various models and manufacturers. Also, take a look at the condition and age of the trailers. There are many financing options available from dealerships, but interest rates can vary depending on who you ask.

An alternative to buying a mobile residence is renting one. Renting allows you to test drive a particular model without making a commitment. However, renting isn't cheap. Renters typically pay $300 per month.